Have you ever wondered why some people seem to make money effortlessly, while others struggle to get by despite working hard? It’s not just about luck, talent, or even the economy—it’s about mindset.

Picture this: you’re sitting in a classroom, learning how to solve for x in a math problem you’ll never see again, while billionaires out there are building empires. Why? Because the system taught you to get a job, not wealth. Robert Kiyosaki, author of Rich Dad Poor Dad, says this traditional path is as outdated as floppy disks. It’s time to rethink how you view money, success, and life.

Let’s break down some game-changing lessons from Kiyosaki’s perspective on the rich vs. poor mindset and why shifting your focus can make all the difference. Spoiler: it’s more about how you think than what you do.

1. The Obsolete Traditional Path

Remember when “go to school, get a job, save money” was the golden ticket? According to Kiyosaki, this advice has aged worse than internet dial-up tones. Here’s why:

Imagine someone saving coins in a piggy bank, thinking they’re beating inflation. Flash forward: that same piggy bank is now worth less than the piggy it resembles. Meanwhile, the rich? They’re out there turning pennies into skyscrapers by playing Monopoly in real life.

- Inflation eats your savings: Saving money isn’t building wealth; it’s just putting it in a slow cooker that barely keeps up with inflation.

- Economic shifts favor the bold: The rich don’t play by the same rules. They invest in assets that grow, while the poor and middle class save in assets that shrink.

Kiyosaki points to the widening gap between the top 1% and the rest of us (99%). The wealthy adapt, innovate, and thrive, while the rest follow an outdated manual that no longer applies to the game.

2. The Internal Mindset of Wealth

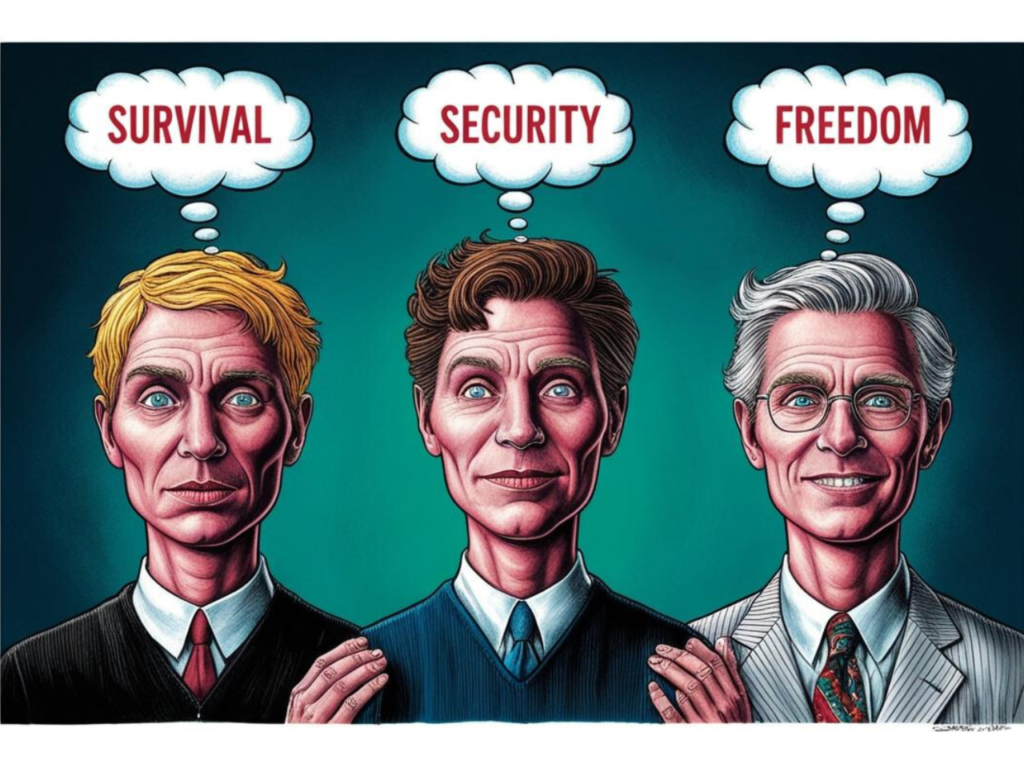

Kiyosaki believes we all carry three personas inside us:

Picture this: three personas inside you arguing. The “Poor Mindset” says, “Let’s just survive today.” The “Middle-Class Mindset” counters, “Let’s save for a rainy day.” But the “Rich Mindset”? It’s sipping coffee, scrolling through investment opportunities, and saying, “Rainy days are when I buy umbrellas on sale and sell them for double.”

- The Poor Mindset: Focused on survival, always asking, “How do I get by?”

- The Middle-Class Mindset: Obsessed with security, always wondering, “How do I stay comfortable?”

- The Rich Mindset: Fixated on freedom, thinking, “How do I create opportunities?”

Now, here’s the kicker: schools don’t teach the rich mindset. Why? Because they’re designed to produce employees, not entrepreneurs. It’s like being trained to play checkers while the rich are out there mastering 4D chess.

3. The Dangers of Paychecks

Here’s a wild take from Kiyosaki’s “Rich Dad”: Paychecks are a trap. Accepting one makes you a “slave to money.” Harsh? Sure. But think about it.

Think of a hamster on a wheel, running endlessly but getting nowhere. That’s the paycheck trap. The rich? They built the wheel, sold it, and now they’re watching Netflix while the hamster keeps running.

- Paychecks create dependency: You trade time for money, and once you’re hooked, it’s hard to think beyond that cycle.

- The rich play a different game: They build businesses, invest in assets, and create systems that generate income, even while they sleep.

Kiyosaki argues that rejecting paychecks forces you to think bigger. It’s about embracing risk, resilience, and the possibility of failure to achieve something greater.

4. Entrepreneurship: A Mindset Shift

Being an entrepreneur isn’t just about starting a business. It’s about reprogramming your brain. Here’s what it takes:

- Adaptability: Entrepreneurs face constant challenges and learn to pivot without a financial safety net.

- Failure as growth: Kiyosaki says failure is the best teacher. Each setback is a lesson, not a verdict.

- Innovation over conformity: Employees follow rules; entrepreneurs rewrite them.

Starting a business is like baking a cake without a recipe. You’ll burn a few, but eventually, you figure out that adding baking soda was the missing ingredient. And when it works, you don’t just have a cake—you own the bakery.

Think of entrepreneurship as the ultimate test of character. It’s not just about making money but about becoming the kind of person who can.

5. Debt and Taxes: Tools for the Wealthy

Here’s a plot twist: Debt and taxes aren’t the enemy. In fact, the rich use them to their advantage.

The middle class looks at debt like it’s a horror movie villain. The rich see it as the hero. Debt bought the rich a house they rented out. Taxes? The rich read the tax code like it’s a treasure map.

- Good Debt vs. Bad Debt: While the middle class avoids debt like the plague, the wealthy use it to invest in cash-flowing assets.

- Tax strategies: Kiyosaki emphasizes that taxes are designed to benefit those who own businesses and invest in real estate. It’s about knowing the rules of the game and using them to your advantage.

While others save for a rainy day, the rich are out there building umbrellas—then selling them.

6. Why the Educational System Fails

You’re in school, learning calculus, but no one’s teaching you how to balance a budget. It’s like training to be a knight but forgetting to bring your sword to battle.

If you’ve ever felt like school didn’t prepare you for real life, you’re not alone. Kiyosaki critiques formal education for:

- Teaching obedience instead of innovation.

- Focusing on memorization instead of financial literacy.

- Preparing students for jobs, not wealth creation.

The result? A workforce that’s great at following instructions but unprepared to thrive in a constantly evolving economy.

7. The Rich vs. Poor Economy Perspective

Here’s a question: How do you view the economy? Kiyosaki says this mindset divides the rich and poor:

During a recession, the middle class says, “Time to save every penny!” The rich says, “Time to buy assets on sale!” It’s like one group sees a storm and hides, while the other builds a wind turbine.

- External economy focus: The poor and middle class worry about stock market crashes, job layoffs, and recessions.

- Internal economy focus: The wealthy see opportunity in every economic condition. They don’t just weather storms; they sail through them.

It’s not about ignoring reality but mastering your inner game so external circumstances don’t control you.

8. Resilience and Adaptability

Life throws curveballs, and the rich mindset is about hitting them out of the park. Kiyosaki highlights two key traits:

- Resilience: Entrepreneurs face setbacks but bounce back stronger.

- Adaptability: The ability to pivot when plans go south is what separates successful people from the rest.

Ever play a video game where you lose all your progress but keep your upgrades? That’s resilience. Entrepreneurs know each failure is just adding XP for the next big win.

When challenges arise, a strong internal mindset helps you keep going, while a fragile one crumbles under pressure.

9. Key Lessons from Rich Dad Poor Dad

Here’s a rapid-fire breakdown of Kiyosaki’s top lessons:

“The rich don’t work for money.” Imagine opening a lemonade stand. The poor mindset sells lemonade. The rich mindset hires kids to run the stand while they set up more stands across town.

Debt as a tool. A middle-class person buys a car to drive; the rich buy a car to rent out. It’s the same vehicle, but one’s a liability, and the other’s an asset.

- The rich don’t work for money: They build systems and let money work for them.

- Debt and taxes are tools, not threats: When used wisely, they can be powerful wealth-building allies.

- Financial education is non-negotiable: Understanding money isn’t optional if you want to succeed.

- Discipline creates freedom: Mastering your emotions and habits is the foundation of wealth creation.

10. The Key Takeaway

Success is like playing Jenga. The poor focus on not letting it fall. The rich? They’re pulling blocks strategically and using them to build another tower.

At the end of the day, success isn’t about luck, timing, or external circumstances. It’s about shifting your focus from what you can’t control to what you can: your mindset, resilience, and vision.

Conclusion

Robert Kiyosaki’s message is clear: The rich vs. poor mindset isn’t just about money—it’s about how you see the world and your place in it. By embracing the principles of adaptability, financial literacy, and internal control, you can start building a life of freedom and opportunity.

Ready to take the next step? Check out the new 20th Anniversary Edition of Robert Kiyosaki’s Rich Dad Poor Dad to learn more about how you can apply these lessons and unlock your potential today!